I preach to my communications clients — “Talk about results, not process. Or at least results before process.” What the hell does that mean? “Your kids’ schools and your roads are falling apart because too many wealthy people and corporations dodge paying the taxes that support the things we all need.”

Tell me what something means in my life before you tell me how it got there.

So here’s Hillary Clinton doing it right. According to The New York Times, Clinton told a crowd in Cleveland Wednesday, “We’re going to tax the wealthy who have made all of the income gains in the last 15 years. The super wealthy, corporations, Wall Street, they’re going to have to invest in education, in skills training, in infrastructure.”

Results not process. Not “let’s change the carried-interest clause,” but “let’s tax the people who’ve made all the money while your income has been stuck or fallen.” And why are we going to tax those who are making the increases? “They’re going to have to invest…” Invest. Pay your fair share to support the things we all use. That seems clear. That seems fair. Voters can get that.

When liberals talk about how trickle-down hasn’t worked, it means something to them but not much to regular human beings. But if you say “The wealthiest aren’t paying their share to support the things all of us, including them, need, and so our schools have no arts programs and barely enough teachers and the roads you drive on are falling apart and our libraries are closed on Saturday afternoons…” people might get it.

Results not process. Hard for a policy wonk like Clinton to not get stuck in the details of what dials she wants to turn to improve things. Hard to say “Here’s what will work better if we turn this dial.”

Clinton can make this work if she talks about results most people would think are needed and fair. Don’t talk about “the common weal” as we Progressives like to do. Talk about the neighborhood school that has 35 kids in a class while Wall Street speculators are lightly taxed on their million-dollar bonuses, each of which would fund 10 new teachers.

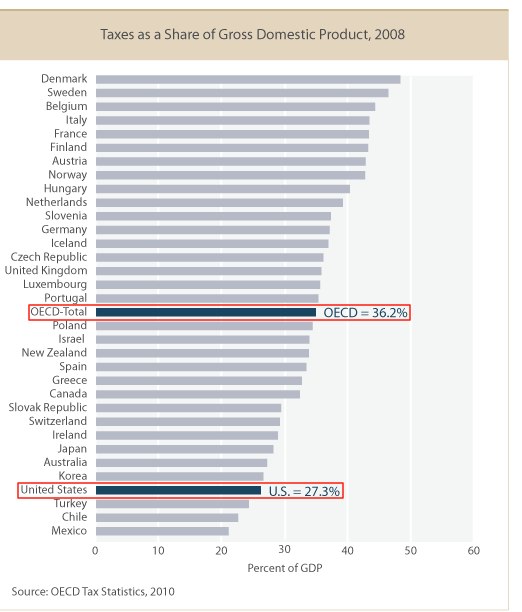

And then she can talk about who pays taxes and who doesn’t. Donald Trump proudly says he works very hard (and spends lotsa dough on expensive lawyers and accountants) to avoid as much tax as possible. He’s proud that he contributes nothing to your local school or police force. Proud of that.

And for those who think The New York Times is liberal and shilling for Hillary, Thursday’s story about her criticism of Trump’s plan to reduce taxes on the rich ends with her saying that Trump doesn’t need a tax cut, and “I don’t need a tax cut.” The story doesn’t mention that Bill and Hillary paid 31 percent in taxes on their income in 2015. Nor does it mention that we don’t know what — if anything, if anything — Trump paid, because he won’t release his returns.

Keep making the tax point about fairness, Hillary, about who’s paying to support the cops and the teachers and the roads we all use. And who isn’t. Don’t focus on the policies. Focus on the schools.

Years ago, when I was still with Shandwick, the global public relations firm, we helped Minnesota and national Indian tribes fight off an attempt by commercial casinos — including Trump’s — to erode the national law that gave tribes the ability to run casinos. Trump et. al. wanted what the Indians had. (Heck, we’ve taken their land, their languages, their religion, their health, their food source, their hope — why not take the economic development tool that’s working for them?) Part of our campaign was showing a picture of a school and a picture of a yacht. Which should public policy support? Another yacht for the wealthy, or a decent school on a poor reservation? Seems pretty clear. And the tribes won that fight.

— Bruce Benidt

Conservatives don’t seem to be given pause by Pawlenty’s unprecedented, unconstitutional application of unallotment powers. But before they get too giddy, they should think ahead a bit. How would they feel about:

Conservatives don’t seem to be given pause by Pawlenty’s unprecedented, unconstitutional application of unallotment powers. But before they get too giddy, they should think ahead a bit. How would they feel about: